Life Insurance in and around Glenwood Springs

Coverage for your loved ones' sake

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

- ASPEN

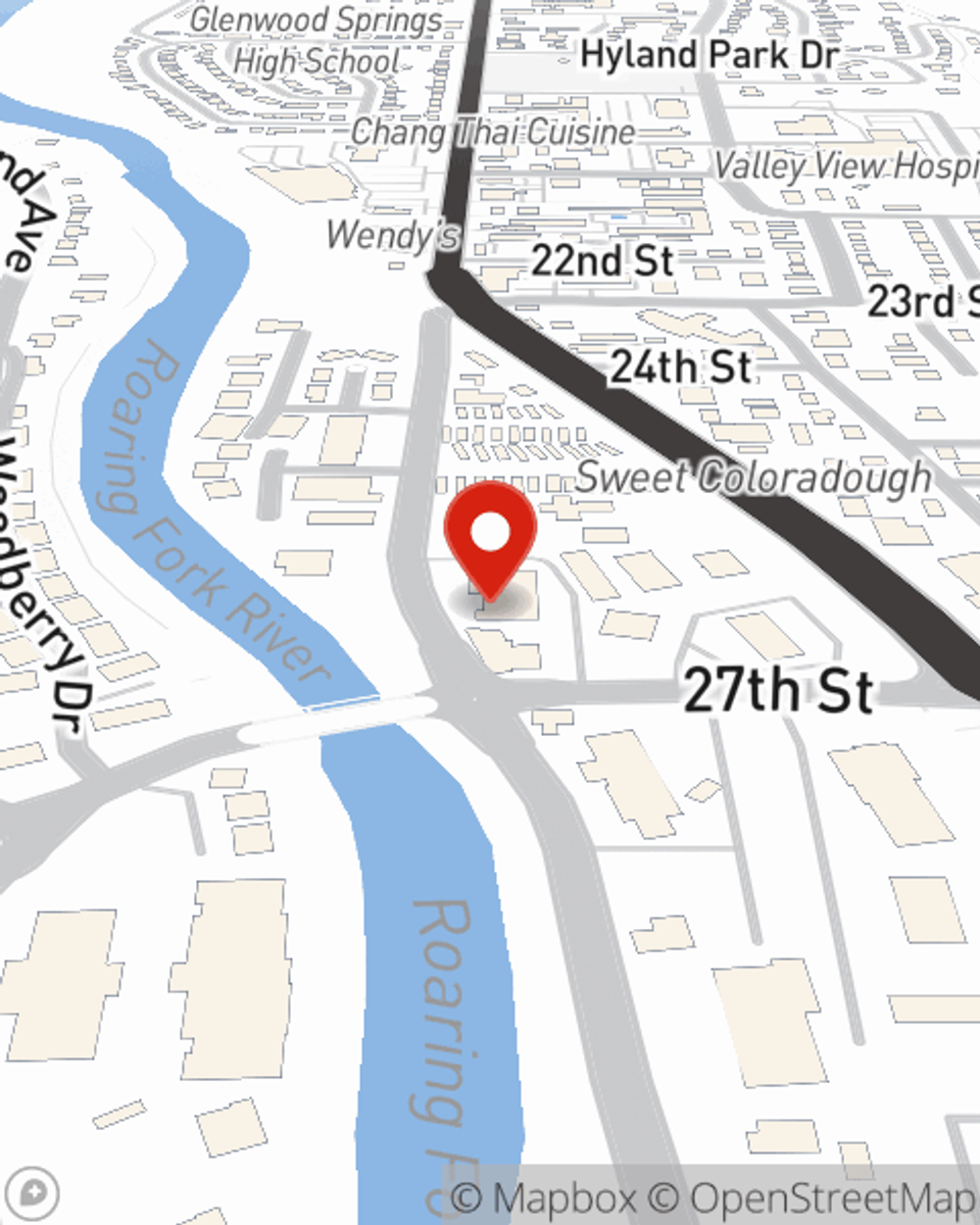

- GLENWOOD SPRINGS

- BASALT

- WILLITS

- EL JEBEL

- CARBONDALE

- RIFLE

- NEW CASTLE

- SILT

- VAIL

- GRAND JUNCTION

- PARACHUTE

- CLIFTON

- FRUITA

Your Life Insurance Search Is Over

No one likes to focus on death. But taking the time now to arrange a life insurance policy with State Farm is a way to express love to your loved ones if you die.

Coverage for your loved ones' sake

Now is the right time to think about life insurance

Wondering If You're Too Young For Life Insurance?

Having the right life insurance coverage can help loss be a bit less debilitating for your family and provide space to grieve. It can also help meet important needs like car payments, medical expenses and retirement contributions.

If you're looking for reliable protection and caring service, you're in the right place. Visit State Farm agent Rodrigo Marquez today to find out which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Rodrigo at (970) 945-2345 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

Rodrigo Marquez

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.